LIC Jeevan Labh Calculator: Your Ultimate Tool for Estimating Premiums and Benefits

November 9, 2025

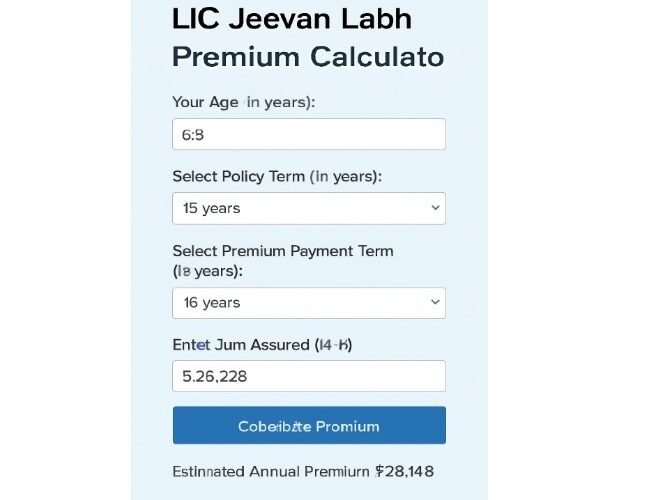

LIC Jeevan Labh Premium Calculator

Introduction

The LIC Jeevan Labh Calculator is a useful tool for anyone who is considering an investment in the LIC Jeevan Labh plan. This plan, which was designed for savings as well as life coverage offers a wide range of flexibility, and also offers an endowment benefit that comes with risk coverage. Utilizing the LIC Jeevan Labh Calculator It is easy to calculate the amount of premiums you’ll have to pay, as well as the anticipated maturity benefits, as well as the benefits that your loved ones could get in the event the unfortunate event occurs.

This guide will guide you through how to utilize the Jeevan Labh Calculator from the Jeevan Labh Calculator, its benefits and how it can aid you in making educated decisions.

1. What is the LIC Jeevan Labh Plan?

The Jeevan Labh Jeevan Labh is a non-linked, active endowment plan which combines savings and protection. It is offered in three policy periods: sixteen years, 21 years as well as 25 years. It also provides security in the event of death within the term of the policy, and the option of lump sums at the conclusion of the term in the event of the possibility of survival. The Jeevan Labh Calculator is designed to provide estimates of costs, death benefits and maturity benefits based upon the specifics of your life.

| Key Feature | Details |

|---|---|

| Policy Term | 16, 21, or 25 |

| Premium Payment Term | 10 15 or 16 years old |

| Minimum Sum Assured | Rs2,00,000 |

| Entry Age | Minimum age of 8 years (up to 59, based on the term) |

| Policy Type | Endowment with life cover plus participation in the bonus |

| Bonus Facility | Basic Reversionary Bonus plus Final Bonus (if there is any) |

2. How Does the LIC Jeevan Labh Calculator Work?

The Jeevan Labh Calculator will help to estimate the following:

-

premium amount Depends on age the sum assured, policy term and premium payment period.

-

Mature Benefit The amount you are guaranteed plus any bonuses announced by LIC should you be able to complete the term of your policy.

-

The death benefits: The greater of the sum that you are guaranteed or a multiplier the annual amount plus any bonuses.

Example:

Imagine you’re a 30 year old person and you choose a 16-year policy term that has a total assured of Rs5,00,000. You also have an annual premium payment for 10 years. You can utilize the Jeevan Labh Calculator to calculate:

-

The annual fee you’d need to pay.

-

It is the maturity benefit is due after 16 years in light of the bonuses declared by LIC.

-

A Death benefit is payable if the policyholder dies during the period.

The LIC Jeevan Labh Calculator provides accurate numbers that are based on these data and gives you an understanding of your financial commitments and anticipated returns.

3. Benefits of Using the LIC Jeevan Labh Calculator

Utilizing using the LCI Jeevan Labh Calculator offers many advantages:

| Benefit | Explanation |

|---|---|

| Accurate Premium Estimation | It is possible to calculate the cost you’ll be required to pay each year based on the amount assured and the the policy’s terms. |

| Helps in Comparing Terms | The calculator lets you observe how the cost of premium and benefits are affected by different policies (16 21, 25 years). |

| Maturity and Death Benefit Insights | It is possible to estimate the maturity benefit total (sum guaranteed plus bonus) in addition to the death benefits by using only a few details. |

| Helps You Plan Financially | It will give you a clear understanding of your financial commitments, helping you decide whether the plan you choose fits your budget and objectives. |

4. How to Use the LIC Jeevan Labh Calculator

Making use of this use of the Jeevan Labh Calculator is easy. Here’s the step-by-step procedure:

-

Fill in Your Age, and gender Calculator uses this information to calculate the price based on age and the term chosen.

-

Select the Policy Duration Choose from 16, 21 or 25 years depending on the length you prefer for time period of the policy.

-

Select Premium Pay Term It can be 10 15 or 16 years based on the term of your policy.

-

Input Sum Assured The sum you want to be insured for is the amount that you would like to be covered for, starting at Rs2,00,000.

-

See Results Results: The Jeevan Labh Calculator from LIC will display an estimated amount of annual premiums, maturities benefits and death benefits.

Example Calculation:

| Age | Policy Term | Sum Assured | Annual Premium |

|---|---|---|---|

| 30 years | 16 years old | Rs5,00,000 | Rs25,146 (approx.) |

| 30 years | 21 years old | Rs5,00,000 | Rs29,524 (approx.) |

| 30 years | 25 years old | Rs5,00,000 | Rs45,372 (approx.) |

Note This is an approximate figure and the actual prices may differ depending on the individual circumstances.

LIC Maturity Calculator: Your Essential Tool to Estimate Policy Payouts

5. Important Considerations When Using the LIC Jeevan Labh Calculator

While the Jeevan Labh Calculator from LIC offers useful estimations, here are some crucial things to think about:

-

Bonuses Cannot Be Guaranteed The benefits at maturity will depend upon the bonus announced by LIC and can change from year to year.

-

Surrender Value If you decide to end your insurance policy prior to the date of maturity the surrender value is typically less than your maturity benefits.

-

Policies Terms Influence premiums The longer the policy term usually results in an increase in premium, but it could give better benefits in the long run.

-

Tax Benefits The premiums you pay are tax-deductible in accordance with Section 80C under the Income Tax Act, and the death benefits are tax-free in accordance with section 10(10D).

6. Conclusion

The LIC Jeevan Labh Calculator is a crucial tool that will assist you in planning and understanding the value of your investments in this LIC Jeevan Labh plan. It gives you an easy method to calculate the cost of your premiums, death benefits and maturity benefits. Utilizing this calculator, you will be able to make a well-informed decision on whether the plan you choose is compatible with your financial goals.

Before purchasing the plan be sure that the price is within your budget and think about how the benefits will align with your long-term goals. The Jeevan Labh Calculator from LIC is a fantastic way to see how your investment will develop over time.