LIC Jeevan Saral Plan 165 Maturity Amount – A Complete Guide

November 13, 2025

If you’re a policyholder for the LIC Jeevan Saral Plan 165 knowing what the maturity amount is vital to planning your finances. In this post we’ll go over how the LIC Jeevan Saral Plan 165 Maturity Amount is determined, what factors determine it, and the ways you can calculate your possible amount of payout. If you’re trying to determine the expected return or interested in how the plan operates, this guide will provide the essential information you require.

What is LIC Jeevan Saral Plan 165?

The LIC Jeevan Saral Plan 165 is a classic fund-building plan that is offered through Life Insurance Corporation of India (LIC). Although this plan’s benefits are no longer offered to new customers, a lot of existing policyholders are still able to benefit from the benefits. It combines risk coverage with a savings element offering financial protection with the chance to increase savings over the course of the policy.

Key Features of LIC Jeevan Saral Plan 165:

-

Premium Flexibility The policyholder can choose their premiums according to their financial goals and preferences.

-

Maturity Benefit This is an Maturity Sum Guaranteed as well as the Loyalty Additions (non-guaranteed).

-

Death Benefit provides coverage for life and pays the amount guaranteed upon death, which includes loyalty bonus.

How is LIC Jeevan Saral Plan 165 Maturity Amount Calculated?

It is the LIC Jeevan-Saral Plan’s maturity value is a mixture of maturity sum assured as well as any Loyalty additions made by LIC. This is a quick overview:

-

SUM Assured at Maturity The sum assured is the guarantee amount the policyholder will get when the policy reaches maturity. It will depend on the amount paid and how old the insured at the time of entry as well as the duration of the policy.

-

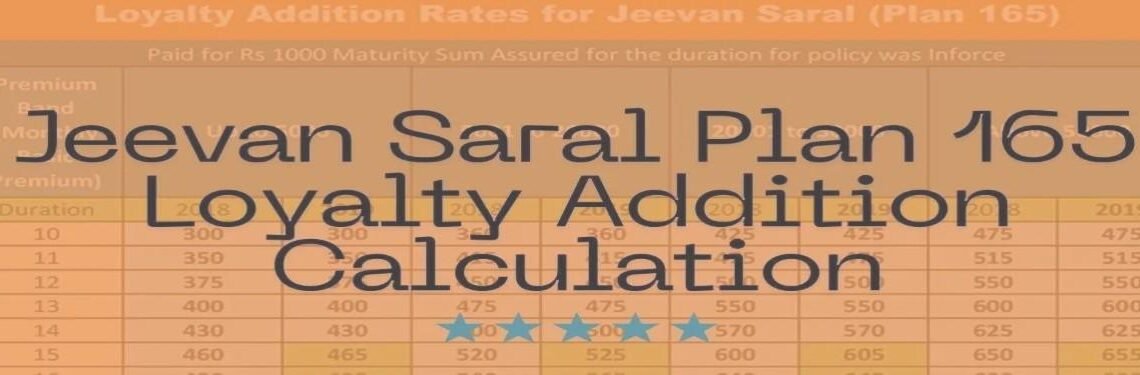

Rewards They are bonuses that are periodically announced by LIC dependent on its performance. While they’re not 100% guaranteed, loyalty add-ons could substantially increase the maturity amount.

Formula for Maturity Benefit:

Maturity Benefit = Maturity Sum Assured + Loyalty Additions

Because loyalty add-ons are not guaranteed the amount of maturity may vary based on bonus rates set by LIC.

Sample Illustrations for LIC Jeevan Saral Plan 165 Maturity Amount

These are examples from what is the the LIC Jeevan Saral Plan 165 maturity amount that are based on various premium scenarios. Be aware the fact that they are estimates and the actual amount of maturity benefits will depend on the amount of your premium as well as the policy term and the declared bonus.

| Entry Age | Annual Premium | Policy Term (Years) | Maturity Sum Assured (Approx) | Estimated Maturity Value with Loyalty additions |

|---|---|---|---|---|

| 35 years old | Rs4,704 | 25 years old | Rs280,200 | Rs426,200 |

| 30 years | Rs3,000 | 20 years | Rs150,000 | Rs210,000 |

| 40 years old | Rs5,000 | 20 years | Rs250,000 | Rs375,000 |

Note: The amount of maturity with loyalty add-ons may differ in accordance with the bonuses that are declared by LIC. These figures are provided for illustration reasons.

Factors That Affect LIC Jeevan Saral Plan 165 Maturity Amount

A variety of factors affect the number of factors that determine the various factors that affect the final Jeevan Saral Plan 165 maturity amount. Understanding these aspects can help you determine the amount you will earn:

-

The Premium The amount you pay directly impacts the maturity sum you are assured. A higher premium typically will result in a greater amount of maturity.

-

The Policy A longer policy term gives more time for loyalty enhancements to build up, and often result in a greater payout at the end.

-

Age at entry Policyholders who are younger typically receive a greater amount of maturity sum assured at the identical premium amount due to the longer duration of their coverage.

-

Loyalty Additional Terms They are announced by LIC according to its financial performance, and cannot be guaranteeable. A higher bonus rate can dramatically increase the amount of maturity.

-

Bonus rates: LIC declares bonuses according to its performance. The rates may change annually which affects the maturity amount.

Star Health and Allied Insurance – Only a Healthy Person Can Dream of Healthy Tomorrows

How to Estimate Your LIC Jeevan Saral Plan 165 Maturity Amount

To calculate the LIC Jeevan Saral Plan 165 maturity amount to estimate the maturity amount, follow these steps:

-

Review Your Policy Document The policy document will include the Sum of the Maturity Assured in relation to the premium and the term you have selected.

-

Contact your LIC Agent Your LIC agent will give you an estimate of Loyalty additions and provide you with more precise projections.

-

Utilize online calculators Numerous online calculators can assist you in estimating the mature amount in relation to your premium term, the length of your contract, and your age at the time of entry.

What Happens at Maturity?

If your policy is due to mature when it matures, you’ll receive the maturity amount assured together with loyalty enhancements when declared. This is what you have to do:

-

Send your maturity discharge forms along with the the original policy bond to LIC.

-

LIC will review an application for maturity and then credit the payment to your account in the bank after confirmation.

Be aware that the amount you get could differ from the expected LIC Jeevan Saral Plan maturity amount of 165 subject to the loyalty add-ons made by LIC.

Surrendering Your LIC Jeevan Saral Plan 165

If you decide to cancel your policy prior to when it matures, you’ll be awarded the price for surrender typically lower than the maturity amount. The policy must be paid for at minimum three years of premiums prior to being able to give up your policy. What is the price of surrender depends on many factors, including the amount of premiums you have paid and the term that the insurance policy is in force.

Conclusion – LIC Jeevan Saral Plan 165 Maturity Amount

The Jeevan Saral Plan of LIC the 165-year maturity amount includes with the maturity sum assured along with Loyalty additions and is an effective security and savings tool. While the maturity sum is secured, the loyalty enhancements will significantly increase the final amount of money paid, based on the bonuses announced by LIC.

To calculate accurately the exact LIC Jeevan Saral Plan maturation amount of 165 you must review the details of your policy, speak with you LIC representative, or utilize an online calculator. This will assist you in planning your finances better and better understand the benefits from you LIC Jeevan Saral policy.